Backtesting software is designed to test potential trading strategies using historical data and measure their performance. It recreates trades and their reactions to a strategy, allowing traders to optimize their approach. On the other hand, FX simulators simulate trading conditions in a risk-free environment, allowing traders to practice and refine their strategies. Both backtesting software and FX simulators can be used to test strategies on live markets, but their focus and functionality differ. Backtesting in forex trading is the process of testing a trading strategy on historical data to see how it would have performed in the past. Initially, traders used computer screens to visualize trade charts and test potential trading strategies.

You need to backtest your trading strategy to be aware of how it will perform under real market scenarios. Backtesting allows you to simulate your trading idea using historical data and put its risk management mechanisms to the test. Backtesting is the art and science of appraising the performance of a trading or investing strategy by simulating its performance using historical data. You can get a sense of how it performed in the past and its stability and volatility.

Getting the price data for backtesting

Patterns are just one variable to consider before entering a trade. If you backtest all your strategies, it can give you a chance to make key adjustments. After you aggregate the data, you need to perform a deep analysis and determine if the results agree with your hypothesis. If you know what you’re doing here, this can be a faster method. Choosing the right one depends on many factors … including what you’re trying to accomplish and what resources you have.

Encore Wire (WIRE) is on the Move, Here’s Why the Trend Could be … – Nasdaq

Encore Wire (WIRE) is on the Move, Here’s Why the Trend Could be ….

Posted: Tue, 13 Jun 2023 12:50:00 GMT [source]

It is highly probable that the strategy performs well without these costs, but it drastically affects the appearance of a strategy’s profitability after the inclusion of these costs. It’s a simple fact, after the year 2000, the companies which survived did well because their fundamentals were strong, and hence your strategy would not be including the whole universe. Thus your backtesting result might not be able to give the whole picture. Consider our strategy on moving average crossover where you need to optimise the moving averages periods.

Methods of Backtesting

It usually provides a decent amount of historical data and the software is easy to use. Therefore, it’s generally best to start with manual backtesting. A seemingly insignificant oversight, such as assuming that the earning report being available one day prior, can lead to skewed results during the backtesting.

For manual testing, you can use a spreadsheet app such as Excel or Google Sheets. This is one way you can gather data and create formulas for testing. If you can lower your chances of losing — and increase your chances of winning — you can potentially position yourself for a long career in trading the stock market. It is essential to understand the market direction before making any decision. In fact, tradewell is a great tool for traders wishing to enhance their tactics and make some good gains, with a large choice of equities to trade and the ability to figure out odds. Another essential thing that defines your success is the correlation among the constituents.

Build Alpha

Both the Bar replay and strategy tester features are available with the free BASIC subscription. Expenses will have a much bigger impact on the profitability of a day trading strategy. Backtesting a day trading strategy requires much more focus and diligence. When you’re doing manual backtesting, do your best to simulate real trading conditions and don’t overshoot your entry.

For example, if you are a long-term trader, then you better backtest your strategy for a period of 5-15 years. Otherwise, short-term traders can use shorter time frames of weeks or months. You should also be aware that, though useful, backtesting may not be the best way to determine whether a strategy will be successful or not. This is because markets keep changing, and past results do not provide a cue for future performance.

Backtesting Tips

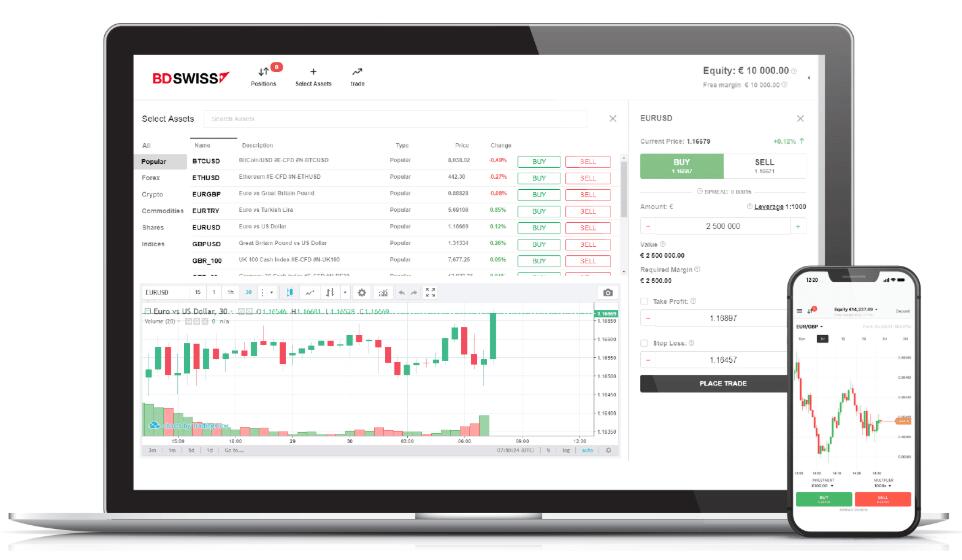

If you want to be a successful trader, you must combine your trading knowledge with backtesting software to make the right decisions. A good backtesting software must have a user-friendly interface and should provide statistical results to measure the strategy’s effectiveness. The platform also allows optimizing the weight of positions based on the highest Sharpe ratio (a measure of risk-adjusted return), lowest variance, highest return, and more. Additionally, for options, you can view potential profit and loss and risk/return ratio in Options Strategy Lab. Is part of the IIFL Group, a leading financial services player and a diversified NBFC. The site provides comprehensive and real time information on Indian corporates, sectors, financial markets and economy.

- Remember, one of the most important things for you to do as a trader is to limit your risks.

- Some software programs are specifically built for certain markets.

- Typically, this involves a programmer coding the idea into the proprietary language hosted by the trading platform.

If the strategy is performing poorly on the historical data, you will discard or re-evaluate the hypothesis. By using historical data, you can backtest and see whether your hypothesis is true or not. It helps assess the feasibility https://forexhero.info/roboforex-broker-review/ of a trading strategy by discovering how it performs on the historical data. For backtesting to provide meaningful results, traders must develop their strategies and test them in good faith, avoiding bias as much as possible.

A higher Sharpe ratio is always preferable over the lower ones. A trading strategy with Sharpe ratio greater than 1 is considered a satisfactory strategy, while a strategy with Sharpe greater than 2 is a good strategy. The Sharpe Ratio can be used to compare the portfolio with the benchmark to get to know how your strategy is repaying for the risk taken on the investment. A cumulative return or absolute return is the total amount of money that an investment has gained or lost over time, independent of the time involved. This is because if you only keep stocks from a particular sector, say technology.