Content

So, it is crystal clear that in cost accounting, “COST” refers to forgone resources to enable production of a finished good or service ready for distribution to the market. Further, when we talk of “COST” we are addressing the supply side of the market. Activity-based costing (ABC) identifies overhead costs from each department and assigns them to specific cost objects, such as goods or services. These activities are also considered to be cost drivers, and they are the measures used as the basis for allocating overhead costs. Standard costing assigns “standard” costs, rather than actual costs, to its cost of goods sold (COGS) and inventory. The standard costs are based on the efficient use of labor and materials to produce the good or service under standard operating conditions, and they are essentially the budgeted amount.

Otherwise after that stage, each product consumes its own resources separately. You should not that after split point, there may arise one good being main and other one being minor (i.e., by-product) in that order. Cost elements under this criterion is based on the characteristic of the element of not being adjustable as per the wishes of the management. Discretionary cost is cost element that can be avoided by the management without interfering with the operations of the business. In other words, expenditure of this nature can be tolerated and at the same time the management can do away with it for this cost is not related to the operations and can be controlled by the management.

This implies that since there are numerous organizations dealing with a variety of products supplied in the market, different criterion is used to classify cost elements. In the next sub-topic in this article, we will discuss the classification of cost elements as explained hereunder. In the context of cost accounting, cost refers to case “a” which entails the actual cost incurred or paid in creating/manufacturing the finished good or service.

Examples of FOR Cost in a sentence

Cost accounting is an internal process used only by a company to identify ways to reduce spending. If a retail clothing business uses some of its profits to invest in stocks, that isn’t considered a cost, because the business isn’t trying to sell those stocks as a part of its primary business model. On the other hand, investing in a billboard ad would be considered a cost, since it’s attempting to drive customer traffic to the store.

Since there are many different ways that a company may try to sell its unique goods or services, concepts of cost are similarly varied. There are many types of costs, such as direct and indirect costs, that a manager must understand to effectively manage a business. It’s common for the marginal cost of serving extra customers to be relatively low. The lower cost of production may allow you to make those extra sales at a higher profit.

This means that costs are higher than the income, and consequently, the company will lose money. When a new company’s business plan is developed, organisers will often create cost estimates. These are used to assess whether the benefits and revenues of a proposed business will more than cover the costs. When creating a business plan for a business, product, or project, planners usually make cost estimates.

Cost Is Also Mentioned In

Understanding a product’s marginal cost helps a company assess its profitability and make informed decisions related to the product, including pricing. Cost elements are classified on the basis of cost or resources that are commonly used to produce two or more products which within a certain stage or process remain twins or joint until past the point of split-off. So, the costs paid or incurred within this section of production is referred to as joint.

Fixed costs are the costs that keep a company running and don’t fluctuate with sales and production volumes. A factory building or equipment lease would be classified as fixed costs. Product costs consist of direct materials, direct labor, and manufacturing overhead. Indirect materials and indirect labor are included in overhead.

What is the difference between cost and marginal cost?

To illustrate this, assume a company produces both trinkets and widgets. The trinkets are very labor-intensive and require quite a bit of hands-on effort from the production staff. The production of widgets is automated, and it mostly consists of putting the raw material in a machine and waiting many hours for the finished good. It would not make sense to use machine hours to allocate overhead to both items because the trinkets hardly used any machine hours.

As a result, ABC tends to be much more accurate and helpful when it comes to managers reviewing the cost and profitability of their company’s specific services or products. A cost price includes all outlays that are required for production, including property costs, materials, power, research and development, testing, worker wages and anything else that must be paid for. The manufacturer must calculate a product’s cost price carefully to avoid taking a loss on sales or not being profitable enough.

How can costs be classified?

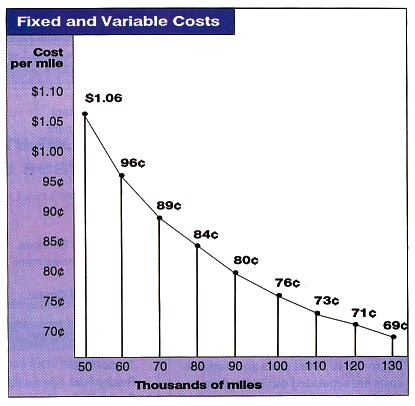

Fixed cost is the cost element of a product that has a behavior of remaining constant or unchanging character such that when the volumes of production change, the cost element remain the same. In contrast to general accounting or financial accounting, the cost-accounting method is an internally focused, firm-specific system used to implement cost controls. Cost accounting can be much more flexible and specific, particularly when it comes to the subdivision of costs and inventory valuation. Cost-accounting methods and techniques will vary from firm to firm and can become quite complex.

Cost, in common usage, the monetary value of goods and services that producers and consumers purchase. In a basic economic sense, cost is the measure of the alternative opportunities foregone in the choice of one good or activity over what is cost definition others. This fundamental cost is usually referred to as opportunity cost. For a consumer with a fixed income, the opportunity cost of purchasing a new domestic appliance may be, for example, the value of a vacation trip not taken.

These two examples consist of cash outlays relating to purchase and selling inventory, but some businesses make their own inventory. Manufacturers invest large amounts of money in equipment and machines needed to produce and assemble products. For example, cost accountants using ABC might pass out a survey to production-line employees who will then account for the amount of time they spend on different tasks.

If you prefer to opt out, you can alternatively choose to refuse consent. Please note that some information might still be retained by your browser as it’s required for the site to function. Underestimating the costs of a business may result in a cost overrun once operations begin.

For instance, a t-shirt manufacturer sets a price for a wholesale t-shirt. That price is paid by a retailer, but to the retailer, that price is actually a cost—it’s the cost of acquiring inventory for the retail store. After acquiring the t-shirt, the retailer will put it out on the sales floor. A customer who wants to buy it will pay the price charged by the retailer, which is usually the retailer’s cost plus an extra amount to bolster the retailer’s profits. The amount that a business charges customers per unit of the product or service it sells is called the price.

For example, the telephone cost tends to vary with the number of employees. A cost can instead be designated as a fixed cost, which means that it does not vary with changes in the level of activity. For example, the lease of a building will not vary, irrespective of the revenues of a business housed within that facility. Typical examples of semi-variable costs include repairs and maintenance costs for plants, machinery, and buildings and supervisor salaries. Typical examples of fixed costs include rent, rates, taxes, insurance charges, and salaries for managers. Fixed costs are costs that generally remain unaffected by changes in sales volume/output.

- In the context of cost accounting, one; cost is the forgone resources by the manufacturers/producers to create or produce a finished good or service.

- Cost accounting is helpful because it can identify where a company is spending its money, how much it earns, and where money is being lost.

- Therefore, the issue of whether a cost is controllable or uncontrollable is determined by the individual or level of management in question.

- Cost accounting has elements of traditional bookkeeping, system development, creating measurable information, and input analysis.

- The production of widgets is automated, and it mostly consists of putting the raw material in a machine and waiting many hours for the finished good.

- Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism.

Selling costs are incurred to create and stimulate demand and secure orders. As such, these costs are incurred in connection with the marketing of products. Administration costs are the costs incurred in formulating business policies, directing the organization, and controlling the operations of an undertaking. Production costs refer to costs that arise in the course of acquiring, processing, and using raw materials.

cost verb

Normal or unavoidable costs are normally incurred at a given level of output under the conditions for which that level of output is normally attained. Each cost is recorded in a different expense account depending on its purpose and cost driver. For example, the cost recorded to purchase inventory is booked in the cost of goods sold account when inventory is sold. These expenses are presented in a section of the income statement separate from the operating expenses.